CCTV News:The Ministry of Industry and Information Technology recently reported the construction of gigabit cities in 2022. By the end of October 2022, a total of 110 cities in China had reached the standard of mega-city construction and completed the summary and evaluation work, accounting for about one-third of all prefecture-level cities. Among them, 29 gigacities will be built in 2021 and 81 gigacities will be built in 2022. In terms of regional distribution, 41 gigacities have been built in the eastern region, 29 gigacities in the central region and 40 gigacities in the western region.

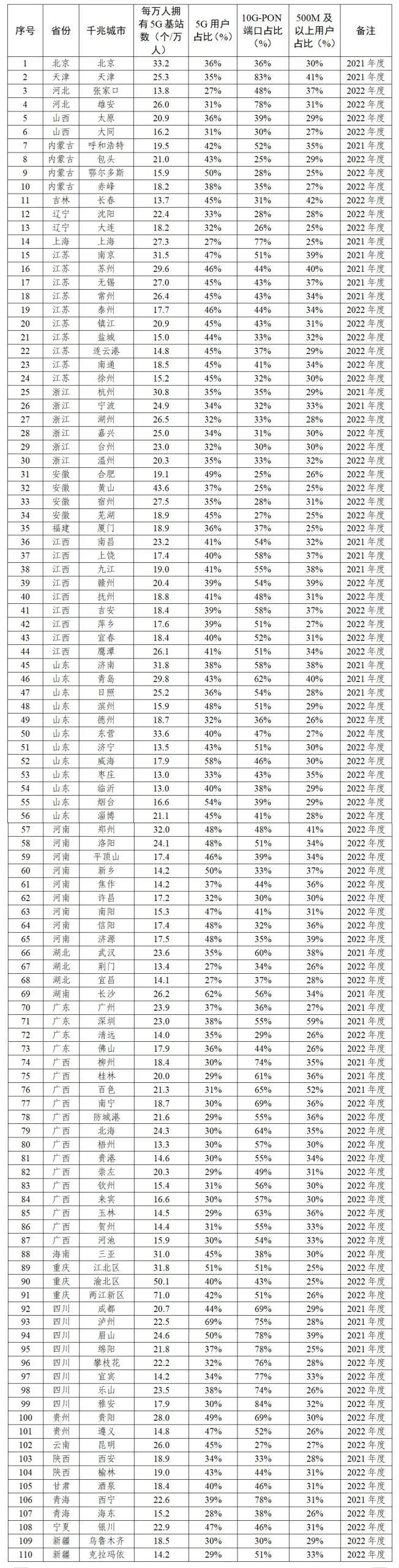

Bulletin on the Construction of Gigabit Cities in 2022

Communication Letter No.327 [2022] of the Ministry of Industry and Information Technology

Communications administrations of all provinces, autonomous regions and municipalities directly under the Central Government, departments in charge of big data industry, departments in charge of industry and information technology of all provinces, autonomous regions and municipalities directly under the Central Government and Xinjiang Production and Construction Corps, and all relevant units:

In order to implement the decision-making arrangements of the CPC Central Committee and the State Council, in accordance with the requirements of the "Double Gigabit Network Collaborative Development Action Plan (2021-2023)", our department has launched the action of building a Gigabit city, and all localities have accelerated organizational construction. The relevant provinces, autonomous regions and municipalities directly under the Central Government have taken the lead in conducting audit and evaluation, and vigorously promoted the "Double Gigabit" network construction, application innovation and industrial development. There are 110 cities in China that have reached the standard of mega-city construction (including 29 in 2021 and 81 in 2022) and completed the summary and evaluation of mega-cities.

Now, the completion of key indicators of each gigabit city (Annex 1) and typical practices (Annex 2) will be notified. Local communications administrations should, jointly with relevant departments and enterprises, thoroughly implement the spirit of the 20th Party Congress, actively organize the exchange and study of experience in the construction of Gigabit cities, continuously consolidate the construction achievements, accelerate the improvement of the application level of "double Gigabit" network construction, promote the construction of a modern infrastructure system, and contribute to accelerating the construction of a network power and a digital China and promoting high-quality economic and social development.

Attachment: 1. Summary of Key Indicators of Gigabit City 2. General Situation and Typical Practices of Gigabit City Construction General Office of the Ministry of Industry and Information Technology

December 18, 2022

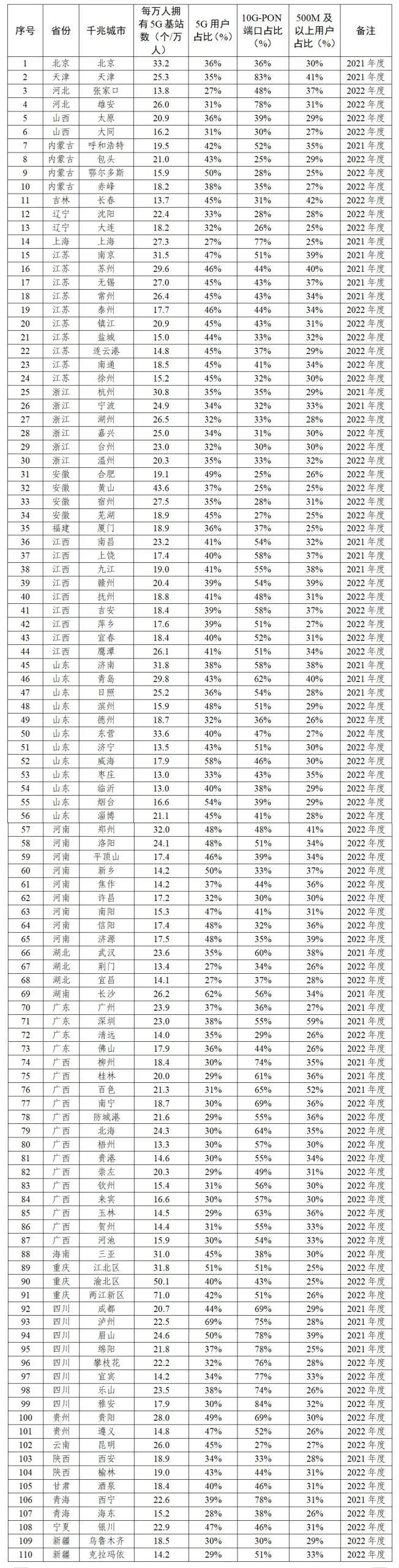

Annex 1

Summary of Key Indicators of Gigabit Cities

General situation and typical practices of gigabit city construction

I. General situation

By the end of October 2022, a total of 110 cities in China had reached the standard of mega-city construction and completed the summary and evaluation work, accounting for about one-third of all prefecture-level cities. Among them, 29 gigacities will be built in 2021 and 81 gigacities will be built in 2022. In terms of regional distribution, 41 gigacities have been built in the eastern region, 29 gigacities in the central region and 40 gigacities in the western region.

Second, the key indicators

(A) "Double Gigabit" network construction

By the end of October, 2022, the average coverage rate of urban family gigabit optical network in China’s gigabit cities exceeded 100%, achieving full coverage of urban family gigabit optical network. The average number of 5G base stations per 10,000 people in gigabit cities is 22.2, which is higher than the national average (15.7/10,000 people). Among them, the first batch of gigabit cities has an average of 25.8/10,000 people, and the second batch has an average of 19.1/10,000 people. The average proportion of 10G-PON ports in gigabit cities reached 46.7%, which was higher than the national average (32.1%), among which the first batch of gigabit cities reached 52.9% on average and the second batch reached 40.8% on average.

(B) "Double Gigabit" user development

By the end of October, 2022, the average proportion of users with 500Mbps and above in China’s gigabit cities reached 32.6%, which was higher than the national average (24.8%), among which, the first batch of gigabit cities reached 34.5% on average and the second batch reached 30.9% on average. The average proportion of 5G users in gigabit cities reached 38.9%, which was higher than the national average (31.1%). Among them, the first batch of gigabit cities reached an average of 38.3%, and the second batch of gigabit cities reached an average of 39.5%.

(III) Coverage of 5G networks in key places

Gigabit cities are municipal public hospitals (above Grade III), key universities, key areas of cultural tourism, and key places such as railway stations (above Grade II), trunk airports and key roads that offer passenger transport services. The access rate of 5G networks is over 80%, and the signal level of 5G networks and other indicators meet the relevant construction standards, among which the access rate of 5G in 84 key places in cities reaches 100%.

(D) "Double Gigabit" application innovation

Gigabit cities have vigorously promoted the integrated application of new technologies such as 5G and Gigabit optical networks in the fields of information consumption, vertical industries, people’s livelihood, digital government, etc., and actively explored the construction scheme and business model of "double Gigabit" network collaborative deployment, bringing digital changes in management and production methods for the development of local characteristic industries and traditional enterprises. Many projects won the national awards of "Blooming Cup" 5G application solicitation competition and "Guanghua Cup" Gigabit optical network application innovation competition. Jiangsu Nantong University Affiliated Hospital has built a "double Gigabit" intelligent operating room, realizing the application of Gigabit optical network+operating room environmental equipment, Gigabit optical network +VR remote surgery teaching, Gigabit optical network+remote diagnosis live broadcast, and reducing the cost of a single operating room from 3 million yuan to 1.5 million yuan, saving construction cost by 50%. Guangdong Foshan Chuangxing Precision Manufacturing Co., Ltd. built a production intranet based on the "Double Gigabit" network, which can simultaneously adapt to multiple application scenarios such as intelligent scheduling, intelligent warehouse management and accurate workpiece positioning. The product yield increased by 16%, the material preparation cost decreased by 12 times, and the labor cost decreased by 38.6%. The application of "Double Gigabit" smart mine in Panzhihua Pangang Group Mining Company of Sichuan Province has realized the application of remote control of open-pit mining equipment and real-time monitoring of high-definition video of operation scenes, and the annual income of application can reach one-third of the construction cost.

Iii. Policy support

Gigabit cities focus on the difficulties and pain points in the construction and application of "double Gigabit" networks in the region, continue to increase policy support, cultivate market demand, guide various market players to exert their joint efforts and actively participate in the construction of Gigabit cities, and a number of typical practices with demonstration effects have emerged.

(A) Optimize the "Double Gigabit" network construction environment

Some gigabit cities have formulated special plans for communication infrastructure, which have been incorporated into the land and space planning at the same level. Ya ‘an, Sichuan, Luoyang, Henan, Taizhou, Jiangsu, etc. listed the Communication Development Management Office as a member of the Municipal Land and Resources Planning Committee, participated in the municipal land and resources planning, and implemented special plans such as optical fiber network construction planning and 5G station site planning in the overall urban planning and regulatory detailed planning.

Some Gigabit cities have strengthened the open sharing of public resources, facilitating the construction of "double Gigabit" networks. Wenzhou, Zhejiang, Dezhou, Shandong, Hohhot, Inner Mongolia, etc., establish a public resource open contact system, and open up social resources such as lampposts, monitoring poles and road signs owned by government agencies, institutions and state-owned enterprises free of charge; Nanyang, Henan Province, coordinates and solves difficult station sites, and promotes the unconditional and free opening of public places such as highways, airports, railway stations, high-speed railway station, large venues and scenic spots to the construction of 5G base stations; Guiyang, Guizhou strictly regulates the types of fees, and promotes the management units in residential quarters, commercial buildings and other places to provide access convenience for the construction of communication facilities. It is forbidden to collect unreasonable fees such as entrance fees, coordination fees and apportionment fees under various pretexts.

In some mega-cities, when examining and approving municipal projects such as parks, roads and buildings, optical fiber pipelines (poles) and base station sites are included in the design review and completion acceptance of building schemes. Ganzhou, Jiangxi, Yichang, Hubei, Yinchuan, Ningxia, etc. will incorporate the construction of communication facilities into the joint drawing review and joint acceptance of new construction, municipal administration, transportation and other projects; In the renovation project of old residential areas and buildings in xiong’an new area, Hebei Province, the construction of optical fiber network was included in the project construction approval management system.

(B) reduce the "double Gigabit" network construction costs.

Some gigabit cities provide electricity security for communication facilities such as 5G, reduce electricity costs, and strictly regulate the types of charges. In Weihai, Shandong Province, Fuzhou, Jiangxi Province, and other deployment areas, the power supply entities of 5G base stations will carry out self-examination and self-correction, and organize market supervision departments to investigate and deal with illegal electricity price increases, electricity charges and other price violations by the power supply entities; Qinzhou, Guangxi, implements fine management of electricity cost, and reduces the network electricity fee of each carrier frequency through the strategy of "one pressure, two changes and three reductions" (one pressure means to reduce the electricity price, the second change means to transform and change the C-RAN into a straight one, and the third reduction means to reduce capacity and combine cabinets, save energy and reduce emissions, and intelligently shut down and save energy).

Some gigabit cities provide financial subsidies in the construction, operation and maintenance of "double gigabit" networks. Xiamen, Fujian, Shenzhen, Guangdong, etc. give each household about 100 yuan subsidies for newly upgraded home broadband users and newly upgraded FTTR users of basic telecommunications enterprises, and give special awards to the winning projects of "Guanghua Cup" application innovation competition; Qingdao, Shandong, yingtan, Jiangxi and Jiuquan, Gansu arranged special funds to support the construction and upgrading of 10G-PON ports, Gigabit optical cats and 5G base stations.

Some gigabit cities have strictly implemented compensation policies for the relocation or damage of telecommunications facilities caused by municipal construction, land acquisition and demolition. Zhengzhou, Henan Province, provided funds for the communication transformation of overhead lines, communication transformation of old communities, subway construction and other engineering projects and put them in place in time; Lianyungang, Jiangsu, compensated the mobile base station site, pole road and pipeline, and the amount of compensation accounted for more than 25% of the expenses needed for restoration and construction.

(C) to strengthen the "double Gigabit" network construction organization and guarantee

Some gigabit cities have established a multi-departmental joint working mechanism led by the main leaders of the municipal government or relevant departments, and incorporated the key indicators of "double gigabit" into the important assessment contents of all districts, counties and departments. Jiaxing, Zhejiang, Yulin, Shaanxi, Dongying, Shandong, etc. set up a 5G network construction leading group headed by the main leaders of the municipal government to coordinate and dispatch the city’s 5G development; Xuzhou, Jiangsu Province established a joint meeting mechanism for 5G construction and application work, and included key indicators of "double gigabit" construction such as 5G base stations and broadband download rates into the assessment of high-quality development of cities and counties; Chongqing Yubei will incorporate the construction and application of 5G into the annual assessment of various departments, towns and streets.

Some gigabit cities have established key supervision mechanisms for difficult station sites, public facilities opening, and power approval. Zhangjiakou, Hebei Province supervises all districts, counties and departments to give key protection to the "double gigabit" network construction in terms of land, power connection, energy consumption indicators, municipal facilities and other resource elements; Sanya, Hainan has listed the construction of Gigabit city as the key supervision item of the municipal government, and promoted the construction of "double Gigabit" network with a series of measures such as "special work class", "financial subsidy" and "list of problems".

In addition, mega cities such as Hefei, Anhui, Karamay, Xinjiang and Yibin, Sichuan actively innovate ways and means, and give strong support to the development of "Double Gigabit" network from the aspects of talent introduction, characteristic application and popular science propaganda.