The train runs fast, thanks to the headband.

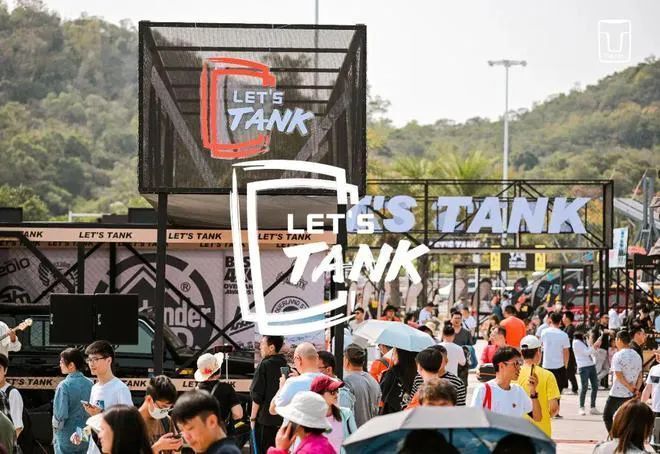

Just like the "locomotive", the train that pulls the China brand off-road vehicle and the China hard-core off-road vehicle market roared forward-although the tank 300 is not the pioneer of the China brand off-road vehicle, its launch has made the potential energy of the weak China brand off-road vehicle more and more powerful, and it has also made a niche.The dull hard-core off-road vehicle market is becoming more and more active.

A set of data can best explain the "speed" and energy of the tank 300. At the end of 2020, Tank 300 went on the market, and in 2021, the sales volume of Tank 300 reached 85,000, accounting for 42% of the market share of the whole hard-core off-road vehicle, which became an instant hit.

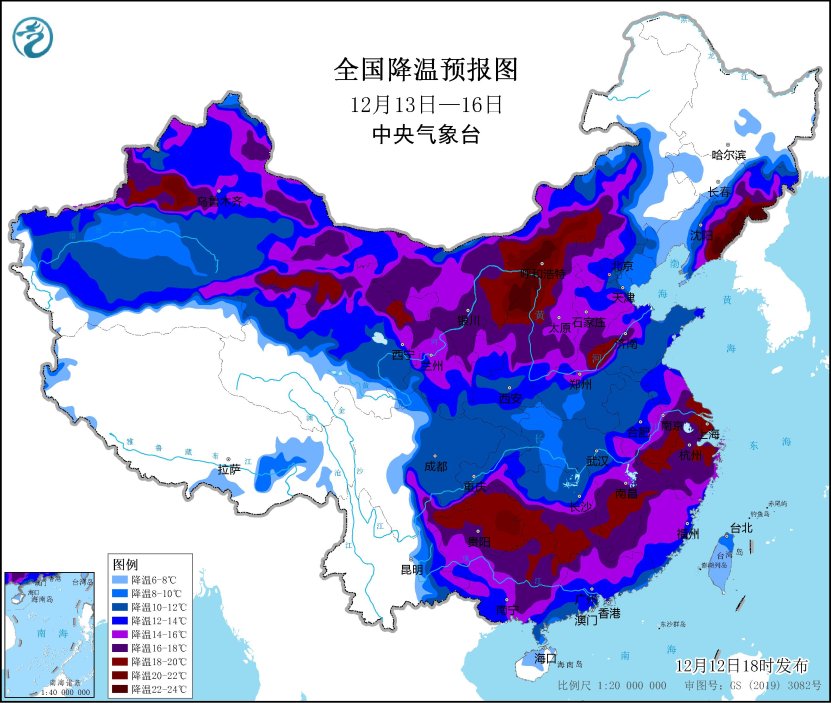

In 2018, the sales volume of hard-core off-road vehicles in China was less than 100,000 units. By 2022, the sales volume of hard-core off-road vehicles in China reached 210,000 units, which doubled in two years. Among them, the sales volume of Tank 300 exceeded 100,000, accounting for 48% of the market share. Tank 300 has activated the hard-core off-road vehicle market in China by itself.

Authoritative data shows that,Among the four best-selling hard-core off-road vehicles in the world in 2022, the tank 300 is second only to.Jeep WranglerRanked second.Behind the tank 300 are the "hard-core veteran players" Bronco and Prado-this is also the "only four" hard-core off-road vehicle with annual sales of more than 100,000 vehicles worldwide.

Tank 300 became the first hard-core off-road vehicle of China brand to really wrestle with the global "top-stream" hard-core off-road vehicle.

In the three years since its listing in December, 2020, the cumulative sales volume of Tanks 300 reached 289,126, ranking first in the sales volume of off-road SUVs in China for 35 consecutive months.

The continuous hot sale of the Tank 300 has invisibly increased the potential energy of the hard-core off-road vehicle market, and many off-road vehicles of China brand have indirectly become the beneficiaries of the "potential energy dividend".

For example, the sales of BJ40, which went on the market earlier, were depressed at first because of the hard-core off-road niche models, but thanks to the trendy marketing of Tank 300 hard-core off-road and its influence on consumers’ minds, the sales of BJ40 also appeared gratifying.The growth of.

More importantly, the tank 300 not only has a positive "pull" effect on the hard-core off-road vehicle market, but also makes the "square box" gradually become an aesthetic trend in the whole automobile market-even in the new energy market, the "square box" has become a common practice.

In the past three years, the "phenomenon" of Tank 300 has been a hot topic in the automobile circle-why is Tank 300 successful and why is it frank?Can the success of G 300 last?

Tank 300 makes the impossible possible.

Before the listing of Tank 300, the hard-core off-road vehicles that China consumers could buy were either expensive and difficult for most consumers to afford; Either the price is relatively close to the people, but the quality and reliability are not so good. For example, Beijing BJ40 and Tanker 300 were listed earlier, but because of the user’s word of mouth, the market performance and presence are not good.

Before Tank 300, in 2019, the most reliable hard-core off-road vehicle that consumers could buy was the domestic Toyota Prado, but the price of Prado’s entry model was close to 500,000 yuan. High price, many off-road players can only "Looking at the ocean and sighing. "

In June 2020,The domestic Prado stopped production, even on the eve of the production stop, the Prado terminal only had a discount of several thousand yuan. The firm price of Prado also reflects consumers’ pursuit and desire for hard-core off-road vehicles at that time.

More than a month after Prado officially announced the suspension of production, in July 2020, the Chengdu Auto Show Tank 300 made its world debut for the first time, and the ground thundered. Tank 300 has become the most concerned model in Chengdu Auto Show.

During the 20 days from the pre-sale of Guangzhou Auto Show in late November to its listing on December 17th, the order for tank 300 exceeded 10,000.Officially listed at 175,800 yuanThe starting price has set a new benchmark for the price of hard-core off-road vehicles. Since then, the tank 300 has been in short supply. On the APP, "reminder"It has become the most common thing that users do in tanks.

The off-road version is in short supply and the production capacity is limited, which makes my cherished tank 300 city version officially listed on July 23, more than seven months later. I successfully placed an order at 0: 08 on July 24, 2021, becoming Tan.One of the 300 "reminders" army. After that, we waited for more than five months. It was not until the end of December 2021 that we got the car keys of Tank 300.

From the tank owner’s point of view, there is only one reason for choosing the tank 300: the price-performance ratio of the tank 300 is "extreme". It used to cost hundreds of thousands to buy a reliable hard-core off-road vehicle, but the tank 300 can be easily done as long as it is in its early 200 thousand. In addition, driving a hard-core off-road vehicle can go to many places that are difficult for cars to reach. I told my daughter that we can only look from one side of the river to the other, but the tank 300 can carry us from there to here. Seeing the world from another perspective may make you see different scenery and be more interesting.

of course,Another important reason why many players are betting on the tank 300 is thatGreat Wall MotorRecognition and trust of hard-core off-road vehicles accumulated in technology for more than 20 years. Off-road vehicles, not cool appearance, fashionable configuration, sharp acceleration, but stability and reliability.

More importantly, the tank 300 has drawn a "boundary" with the dull traditional hard-core off-road vehicle since its listing; In addition to the traditional hard-core products of off-road vehicles such as "three locks", "part-time 4wd" and "front double wishbone rear integral suspension",Tank 300 also integrates the trend, fashion and off-road lifestyle into marketing, which makes the hard-core off-road vehicle have the attribute of "hard-core fashion toy" for young people for the first time.. This is unprecedented in cross-country circles.

The ultimate performance, the ultimate cost performance and the creative marketing of "fashion hard-core big toys" of hard-core off-road vehicles have jointly achieved the top 300 tanks.There is no "tank phenomenon".

Emotion-driven cross-country

At first glance, the continuous success of Tank 300 is the success of the product, but in essence it is the success of the brand concept.

Tank 300 has laid a distinctive IP for the hard-core off-road of the tank brand, and the tank brand is also subtly "empowering" the tank 300.

Liu Yanzhao, CEO of the tank brand, made it clear in an interview that "we insist on the brand proposition of’ iron man’s tenderness’. Tanks have both the tough side of hard-core off-road strength and the tender side of off-road feelings.Tanks are not only cars, but also off-roadWe insist on working with users to create a desirable lifestyle, and in this process, we will establish an emotional bond and empathy between the brand and users. "

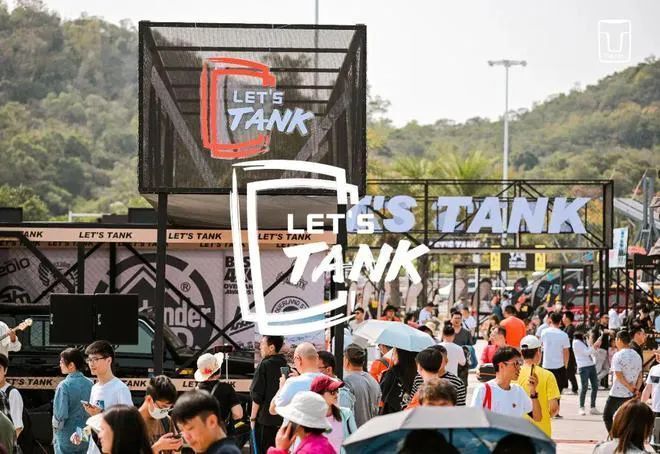

The tank brand is "not only about cars, but also about off-road". What is reflected behind this concept is that the tank brand wants to make off-road a reality.Lifestyle, and then let the brand and users, users and users form a solid emotional link. Therefore, tank brand activities, together with users.Play quite "out of the circle".

In March last year, the first user brand conference of tanks was that tank brand owners played the role of organizers and completed all activities from user conference planning to on-site hosting and performance. At the conference,TANK damage released "tank" LIFE Tanks burn life "user brand, and this also builds a" brand moat "outside the product..????????

San Pu, a famous Japanese sociologist, said in the 4th Consumer Consumption Era:People’s judgment of value is no longer confined to the satisfaction of material and service consumption, but whether the relationship between consumers and people can be established. Consumers promote communication with people and form a circle by buying goods, which is the significance of future "human" consumption. From this perspective, tank 300 has become the spiritual carrier of people who love off-road lifestyle.?????????

Modification, co-creation and cross-country culture are also important ties between tank brands and users, which is also an important starting point for tank brands to "expand their circle". At present,Car owners selectively modify their cars according to their own intentions, which is also a part of tank brand culture.

For example, one of the most groundbreaking and representative modification schemes is to replace the highlights of retro models.Hub-A hub scheme of spoke plate based on the stamping process of steel hub in 1960s and 1970s.

Before the birth of Tank 300, this retro scheme was only sought after in Japan’s minority circles. Now, the tank is 300 straight.The market for retro wheels has caught fire. In this case, the retro wheel hub brand is naturally very willing to participate in the co-creation of tank brands and the construction of tank brand culture.

It is worth mentioning that the tank brand also provides opportunities for tank users in different fields to show exchanges and win-win cooperation in brand activities. I know a friend who is a car simulation RC remote control car. He is also the owner of the tank 300. After the tank 300 became increasingly popular, he put more energy into developing the simulation RC remote control car of the tank 300.

At present, the simulation RC remote control car of tank 300 has become a minor celebrity in the off-road circle. My friend got the pleasure of cross-country life through the tank 300, and at the same time realized the business "circle expansion" with the help of the tank platform.

Liu Yanzhao said, "Tank is a platform, on which everyone can have their own business model and reasonable business model, so that they can support us and we can drive them.”。

Write it at the backTank 300 has become a "national hard-core off-road vehicle", and it is also the popularization of hard-core off-road vehicle culture in China. In a certain sense, the birth of Tank 300 and the continuous popularity of its sales are the signs that China’s automobile market has changed from growth to maturity-since Tank 300, China’s automobile consumption has really entered an era of personalization and fun.

Tank 300 is the "locomotive" of China brand hard-core off-road vehicle, which is worthy of the name.