High-end Interview: "China is an impressive development model" —— Interview with Brazilian President Lula

Xinhua News Agency, Brasilia, April 12th Interview: "China is an impressive development model" — — Interview with Brazilian President Lula

Xinhua News Agency reporter Bian Zhuodan Chen Weihua Luo Jingjing

On the occasion of his state visit to China, Brazilian President Lula said in an exclusive written interview with Xinhua News Agency a few days ago that Pakistan-China relations are of great significance to the two countries and the world. He stressed that Brazil "shares many views with China" and looked forward to a "very fruitful" dialogue with China leaders.

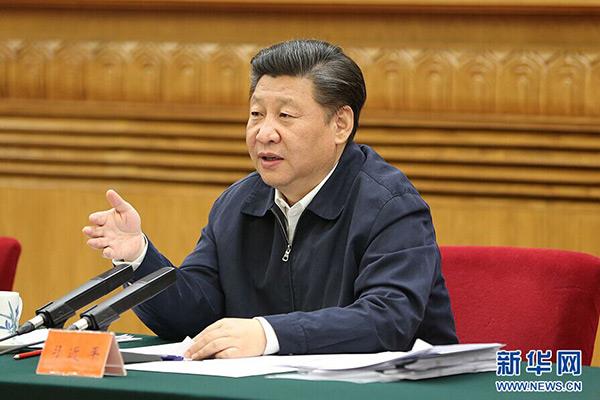

Portrait of Luiz Inacio Lula da Silva, President of the Federative Republic of Brazil. Xinhua news agency

Looking back on his contacts with China for more than 20 years, Lula said: "When I first visited Beijing, almost no one would have thought that Pakistan-China relations were of such great significance today."

In 2003, Lula became president of Brazil for the first time. Since then, the trade volume between China and Pakistan has grown steadily. "China has become Brazil’s main trading partner; Outside the economic field, the political relations between the two countries have also deepened. " Lula said.

According to Pakistani statistics, by 2022, the trade volume between China and Pakistan has exceeded 100 billion US dollars for five consecutive years, and China has become Brazil’s largest trading partner for 14 consecutive years.

On April 12, agricultural machinery harvested soybeans at Banderinia Farm in Goias, Brazil. Xinhua News Agency (photo by Lucio tavola)

When talking about China-Pakistan economic and trade relations, Lula is like a treasure. He said: "Our exports to China are greater than our exports to the United States and the European Union combined. China is currently the main engine of Brazilian agriculture, and I hope that China will become a powerful engine for Brazil’s re-industrialization. "

Lula expressed his expectation for China-Pakistan cooperation to promote the sustainable development of Brazil’s economy. He said that the cooperation between the two countries in biofuels and green hydrogen energy has great potential, and "we should redouble our efforts in scientific and technological innovation and turn cutting-edge scientific knowledge into practical application."

Lula said that the Brazilian government is promoting investment plans aimed at improving national infrastructure, including ports, airports, highways, railways and energy. "There is great room for cooperation and investment with China in these fields."

This is the Rio converter station of the second phase transmission project of Meilishan Hydropower Station in Rio de Janeiro, Brazil (photo taken on November 6, 2019). The second phase transmission project of Meilishan Hydropower Station was independently won by China State Grid, which transported clean hydropower from northern Brazil to the southeast, creating an "electric highway" for Brazil. Xinhua News Agency (Photo courtesy of State Grid Brazil Holding Company)

Lula spoke highly of Chinese modernization. "The success of Chinese modernization shows that there is no single prescription for development, and each country must follow its own path according to its historical challenges and its own strength."

Lula pointed out that Brazil is currently committed to building a "road to Brazil’s modernization", which will combine economic growth, reduce poverty and social inequality, and ensure the sustainability of natural resources. "We hope to achieve growth under social justice, environmental sustainability and respect for democracy and human rights."

As the leader of the Brazilian Labor Party, Lula attaches great importance to solving the problem of poverty. He said that China’s poverty alleviation experience is precious and enlightening to all developing countries. "Hundreds of millions of people in China have been lifted out of poverty in the past 40 years, which is extraordinary and an inspiration to all developing countries."

He said, "China is an impressive development model, and global trading partners, including Brazil, have benefited a lot from the development of China."

Lula pointed out that Brazil and China can strengthen cooperation in safeguarding peace, strengthening multilateralism, eradicating hunger and poverty, and tackling climate change. "Today, it is more important than ever to promote development, strengthen multilateralism and safeguard peace. It is equally important that Brazil and China continue to express their opinions on these issues. "

Lula believes that in the field of global governance, the United Nations Agenda for Sustainable Development in 2030 comprehensively expounds the transformation of the ideal of sustainable development into the common prosperity of all people, which is a good guide for relevant fields. He suggested that Pakistan and China should coordinate more in international organizations and multilateral institutions such as the International Labour Organization, UNESCO and FAO.

Lula also emphasized the role of BRICS countries in establishing a more democratic and inclusive international order. He said, "It is essential to maintain the characteristics and consistency of the mechanism, which means supporting multilateralism and promoting developing countries to play a more important role in the international system."

Lula believes that strengthening cooperation between Pakistan and China is also of great significance for human beings to cope with climate change. "Climate change is a concrete threat, especially affecting vulnerable people, and may hinder our efforts to eradicate poverty and hunger." Lula said, "Brazil and China can promote the transition to a low-carbon economy. Brazil has a clean energy matrix that can be expanded and combined with China investment. "

Lula also expects China to play a role in promoting regional integration in Latin America and the Caribbean. "Without roads, railways, transmission lines, telecommunications and air and sea connections, it is impossible to achieve regional integration." Lula said, "China can play an active role in helping to integrate the infrastructure in the region."